In this newsletter, we will be examining the subject of self-purchase from the perspective of international taxation following the recent case law on the subject in Israel. The ruling by the District Court on the Beit Husan case, Tax Appeal 71455-12-18 on November 5, 2020, permits companies to execute self-purchases, where there is a business reason for the transaction, without the need to cope with the tax implications regarding the taxation of notional income or the classification of income from the sale of shares by a foreign resident as a capital gain (which in most cases is exempt from tax in Israel under the force of the internal law or the provisions of the tax treaty) or as a dividend, for which tax must be deducted at source.

On September 26, 2021 a ruling was handed down in the case of Meir Saida 38294-02-19, which dealt yet again with the question of the tax liability of shareholders in a self-purchase transaction.

The Tax Authority’s position on the issue of self-purchase

The tax aspects regarding a self-purchase were determined in a circular that was published by the Tax Authority (Number 2/2018): where a company purchases its shares from all of the shareholders, proportionately, the purchase will be viewed as the distribution of a dividend, whereas on a self-purchase other than “pro-rata”, the two following approaches are calculated:

The first approach: The purchase will be viewed firstly as the distribution of a dividend to all of the shareholders (those remaining and the seller) in accordance with their shares before the self-purchase, and afterwards it will be viewed as if the remaining shareholders had purchased the shares from the selling shareholders. In other words, part of the amount that has been received by the seller will be classified as a dividend and an additional part will be classified as a capital gain.

The second approach: First, the remaining shareholders will be viewed as if they have purchased the shares from the selling shareholders, in the amount of the purchase in accordance with their relative shares in the Company. Afterwards, they will be viewed as if the remaining/ purchasing shareholders have transferred the shares that they purchased to the Company, in consideration for the amount of the purchase in an exchange transaction, such that a dividend will arise for them at the level of the amount of the purchase. The Tax Authority’s position is that this approach is to be adopted primarily where the selling shareholders have sold all of their shares in the company and afterwards, they have not holdings at all in the Company and indeed this is the approach that the Assessing Officer sought to implement in the Saida case.

The ruling in the Saida case

The Court determined that there is a significant difference in the facts between the Husan case and the Saida case and it adopted specifically the first approach in the Income Tax circular, as described above.

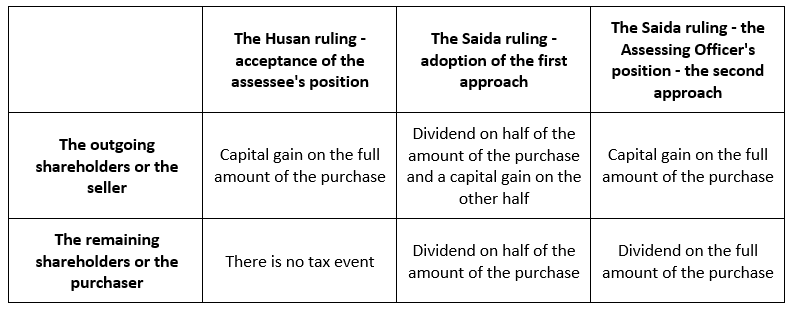

The following table summarizes the rulings by the District Court and the approach adopted by the Income Tax Department from the perspective of the remaining shareholders and the selling shareholders:

It arises from an analysis of the tax events in the table that the classification of a remaining shareholder’s income or that of the purchaser (in the event that a tax event has occurred) will be dividend income and the classification of the selling or outgoing shareholder will be classified as a capital gain or as a dividend or as a combination of the two.

The implications of the different classification for the outgoing or selling shareholders

In the event that the income is classified as a capital gain – the difference between the consideration and the shares’ cost will be taxes as a capital gain. If it is classified as a dividend – the full amount of the dividend will be taxed and the Company will be required to deduct tax at source.

In the event that the outgoing shareholder is a foreign resident individual

The classification of his income as a dividend will be taxed, generally at a rate of 25%/ 30% with the addition of surtax, or at a lower rate if he is a resident of a country with which Israel has a tax treaty.

The classification of the income as a capital gain and not as a dividend may, however, increase the tax rate in certain circumstances (the marginal tax rate in a linear calculation up to the determining time (January 1, 2003) however it may also result in a full exemption being given if the provisions of Section 97(B2) or 97(B3) of the Israeli Tax Ordinance are met, and in a treaty country, the exemption is usually granted and may even be broader.

In this connection, it can be mentioned that in certain circumstances, there may be a claim both in respect of a remaining shareholder and in respect of an outgoing shareholder that part of the consideration on the self-purchase, which is classified as a dividend pursuant to the provisions of the internal law, is to be classified as a capital gain pursuant to the provisions of the treaty.

In the event that the Company executing the self-purchase is foreign resident

A new immigrant, a returning veteran resident and a returning resident will benefit from a tax exemption on a dividend for a period of 5 to 10 years in accordance with their status, whereas for a capital gain, the exemption is for a period of 10 years and a partial tax exemption will be given for the period thereafter.

If the outgoing/ selling shareholder is a company that is resident in Israel, the classification of the income as a capital gain and not as a dividend will negate the possibility of receiving an indirect tax credit (in contrast to the dividend approach).

To summarize, the ruling brings up the issued that engage in a self-purchase event yet again. However, let’s remember that this is a ruling by the District Court. Until there is a final ruling, it is expected that uncertainty will be there regarding this issue, and we would recommend that each case should be examined thoroughly, in accordance with the specific circumstances.

Share: